Seedin is Southeast Asia’s leading Business Financing Platform where local businesses, seeking short-term financing, connect with business entities, seeking short-term investments. Our mission is to link businesses and investors so that businesses can access alternative sources of funding and investors can diversify their investment portfolios.

Yes, Seedin is regulated (license pending) under Securities and Exchange Commission (SEC)’s rules and regulations on crowdfunding activities as defined by SEC Memorandum Circular No. 14 Series of 2019. You may access the SEC Memorandum Circular No. 14 Series of 2019 by clicking

here.

Seedin rigorously scrutinizes a project’s credit risk and asks for collateral to secure its loans. We assist committed borrowers in arranging for short-term loans with competitive returns to be repaid monthly to our investors. By fostering financial inclusion, we allow companies to find a secure and productive means of development and investors to pursue new investment opportunities.

Please refer

here, to learn more about the benefits of investing with Seedin.

Short-term investments enable you to get the most out of your liquid assets. As a result, you may fully utilize your funds in Seedin to receive higher returns in a short amount of time. With short-term investments, profits on your assets remain liquid and reusable due to faster turnover rates.

In comparison to long-term investments, short-term investments provide little or no interest aging. However, our returns are higher than Traditional Financial Service products with similar tenures. Our rates average 7% per annum.

Crowdfunding is the offering or selling of limited-scale securities, typically for start-ups and micro, small, and medium-sized businesses (MSMEs), via an online electronic platform. Crowdfunding is a method of raising funds in which a vast group of investors pools their resources to help finance a project. You may refer to this article to know more about crowdfunding:

5 Things You Need To Know Before Investing In Crowdfunding.

On our online and app platforms, Seedin allows visitors to view content that is publicly accessible. It does, however, reserve the use of its information and services to members who have registered and achieved 100% status. The necessary documents and files should be sent for the KYC (Know Your Customer) verification process to obtain complete access.

Only registered members of Seedin with 100% account status can gain access to the information and services provided by the platform. All needed information and files should be submitted for the KYC (Know Your Customer) verification process.

Select "GET STARTED TODAY" at the bottom of our home page. Alternatively, you can register by clicking

here. You may also register using the referral link sent to you by your fellow investors.

Becoming a part of Seedin is an easy process. However, to fully utilize our services, we require our users to complete our onboarding process, this allows us to know our customers and validate their information.

All projects that will be posted on the platform have a 30 days subscription period for the completion of the documents between the Issuers and the bank.

After finishing the onboarding process, users of the platform agree not to contact other members directly or attempt to enter into any transactions with other users other than via Seedin's official platform and services. This ensures that everyone's interests and welfare are safeguarded.

If it appears to us that the member or the account has been used in breach of the Terms of Use or any applicable rules, Seedin reserves the right to suspend or terminate the account.

We take every precaution to safeguard our users' data from unauthorized access. We strongly oppose any effort by a hacker or a government agency to gain unauthorized access to our customers' records.

However, Seedin is entitled to share the information acquired on the platform with its subsidiaries and/or affiliated companies as long as disclosure requirements of regulatory authorities are complied with. Consequently, any personal information gathered may be shared with third parties in conjunction with the services they offer (including, but not limited to, credit bureaus, debt collection agencies, and law firms).

Risk underwriting processes and procedures are methods of deciding whether or not a borrower is qualified for a loan and if so, the interest rate they would be paying. Fund Seekers or Issuers will have to submit the following documents for credit assessment:

- DTI Certificate or SEC Certificate with latest General Information Sheet (GIS)

- Audited Financial Statements (AFS) with Income Tax Returns (ITR) for the latest 1-3 years, stamped received by BIR

- Interim FS if available and/or management report (balance sheet and income statement)

- Accounts Receivable & Accounts Payable aging report as at most recent month-end (with contact details of the suppliers/customers)

- Recent 6 months statement of account for all corporate bank account

- Trade references and their contact persons and contact details (3 major suppliers and customers)

- Statement of collaterals such as property, surety, guarantee, or accounts receivables to be used

The credit department will run checks on the following:

- From the financials, the credit department will gauge the financial leverage and health of fund seekers;

- From the bank statements, the credit department will look out for indication of bounced cheques, frequent overdrafts, and sales volume;

- The credit department will detect from the debtors/ creditors aging report any significant payment overdue.

Stakeholders of Seedin Technology Inc. will be notified in the case of business cessation.

Our Partner Bank(s) Trust Group holds all of our members' funds in a separate account. If Seedin ceases operations, members will be able to withdraw their funds without difficulty.

Seedin does not charge any advance fees or hidden fees; the total cost of borrowing (interest rates and platform fee) includes the interest rate, which is determined by each SME borrower's unique circumstances.

SeedIn currently has a minimum requirement for businesses to be either registered as a Sole Proprietorship, Partnership or Corporation Entity(s).

No, SeedIn will only accept funding requests from businesses registered in the Philippines.

Issuers will have to submit the following documents for credit assessment:

- DTI Certificate (Sole Proprietor)

- SEC Certificate with latest General Information Sheet (GIS) (Corporations)

- Audited Financial Statements (AFS) with Income Tax Returns (ITR) for the latest 1-3 years, stamped received by BIR

- Latest Interim Financial Statements and/or management report (balance sheet and income statement of the current year)

- Latest Accounts Receivable Ageing Report

- Latest 6 months statement of account for all corporate bank account (online bank statements or passbooks "must include account name and number")

- Valid ID of company President w/ specimen signature/s

- List of Outstanding Loans & Statement of Collaterals

- SALN Details

- Business Continuity Plan (BCP)

- Board Resolution (loan amount should be indicated)

You may apply for funding on our website by clicking

here. Registration and login are needed to apply for an application

If there is a good fit, one of our underwriters will email you to negotiate the funding in detail and to clarify the following procedures after reviewing your application. The more details you give in the initial review, the more likely you are to receive funding.

For further inquiry, please feel free to email

info@seedinph.tech.

Depending on how efficiently the business owner files his or her documents, funding may be closed in as few as three days.

We will contact the SME owner for additional discussions and questions after obtaining all required information. After that, the credit risk team and underwriter will evaluate the company, provide financing terms, and reach an arrangement with the business owner. Once the underwriter is satisfied with the due diligence, the underwriter will draft a Credit Memo for internal approval and review by our Credit Risk Committee, and the funding will close.

No, it is not the case. All information submitted to Seedin is strictly kept private and confidential.

Financials and company records are only made available to investors for review once the contract has been established and both parties have been known.

Seedin secures all personal information using bank-level encryption. To prevent the security issues associated with SMS password delivery, we use a proprietary encrypted one-time password sent via your cell phone to enter your account.

Although our crowdfunding site is hosted on Google's servers, all confidential information is held on a local server. Our website mainly serves as a conduit for data and does not hold any personal information.

No, once the funding request is uploaded, it cannot be withdrawn. The contracts would have been signed and legally binding.

SeedIn is dedicated to assess all funding applications with competitive rates quickly so that SME owners may focus more time on running their business. Being a crowd funding platform, we have the ability to craft flexible capital structures that will complement your business plans. We endeavour to build a community of investors who have faith in your business model and are looking forward to your eventual success.

Coupled with great customer service and our dedication to help SMEs grow healthily, you may receive the benefits of technology, e-commerce and online social community all at once.

SeedIn employs the concept of pre-funding; we invest our own money into the funding before releasing it on our crowd funding platform. If the funding request is not fully subscribed, the remaining funding positions will be retained by us.

Registration and Account Information

You can download the

Investor Manual for step-by-step guide.

A qualified investor is a bank, a registered investment company, an insurance agency, or some other individual designated by law as a qualified buyer by the Commission. A retail investor, on the other hand, is someone who is not entitled to be a qualified investor.

Upon registration, you will be asked to provide basic information like your name, address, and contact numbers. Documents will be requested to validate the information provided. Submission of the following documents is required:

- Two Valid IDs

Valid IDs are needed to confirm your identity. The BSP accepts the following:

- Passport

- Driver's License

- SSS Card

- GSIS E-Card

- NBI Clearance

- PRC ID

- Police Clearance

- Postal ID

- Voter's ID

- Barangay Certification

- Senior Citizen Card

- Overseas Workers Welfare Administration (OWWA) ID

- OFW ID

- Seaman's Book

- Alien Certification of Registration (ACR)

- Government Office and GOCC ID, e.g. Armed Forces of the Philippines (AFP ID)

- Home Development Mutual Fund (HDMF ID)

- Certification from the National Council for the Welfare of Disabled Persons (NCWDP)

- Department of Social Welfare and Development (DSWD) Certification

- Integrated Bar of the Philippines ID

- Company IDs issued by private entities or institutions registered or supervised or regulated by either BSP, SEC, or IC

- A selfie holding one government-issued ID

One valid ID must be photographed with the person carrying the valid ID as an added precaution.

- Bank Proof

For us to verify your records, your bank proof must include your name, account number, and other bank details. Please make sure that all data are clear in the provided documentation.

- Billing Statement

Any household bill that assists us in verifying your address is considered a billing statement. Please ensure that your address is visible.

Please keep in mind that we only allow documents in the .jpeg, .jpg, .png, .gif, and .pdf formats with a maximum file size of 5MB.

Any Philippine-registered corporate body (with DTI/SEC Registration) can be qualified as a corporate investor.

Certified true copy of the latest DTI Certificate, or SEC Certificate with General Information Sheet (GIS)

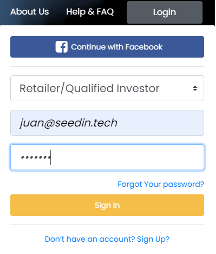

Retail/Qualified Investors can upload the documents via our website as prompted during the registration process.

Seedin will review the necessary documents after they have been sent. Registration will be processed in an average of three (3) working days.

Yes, however, it is dependent on your nationality and other circumstances. Please notify us if you need any additional details. Otherwise, we only enable investors who are citizens or permanent residents of the Philippines to invest in our products. To apply, investors must have both a Philippine-based mobile number and bank account.

Sensitive information on investor accounts cannot be modified for security purposes. They are your registered email address, bank account details, and mobile phone number. To modify, submit an email to

info@seedinph.tech with the specifics and attachments needed to update your account information.

In consideration of Seedin providing the Platform and Services to you, as an Investor, we charge a Risk Management Fee of at least 10% of the Interest Earned.

The Risk Management Fee shall be deducted from the proceeds of repayment of the Participation Amount and Dividends due to you under the terms of the Participation Agreement. The proceeds, net of the Risk Management Fee, shall be deposited into the Escrow Account and held in escrow on your behalf. Proceeds are subject to 15% Creditable Withholding Tax (CWT).

These fees are charged to cover the costs associated with administrative, servicing, and compliance. Kindly refer to Seedin's

Terms of Use for full information.

Investing with Seedin

Investing in Seedin is as easy as 1-2-3:

- Download our mobile app and complete your profile. You can also use your E-wallet account such as Gcash, Coinsph & Paymaya if you don't have a PH bank account.

- Once your Seedin account is approved, you can top up funds to your Seedin app (bank transfer, online banking, mobile wallet, over the counter, cheque). For BDO/BPI Online Bills Payment, select Payexpress/Paynamics.

- Set up your Alfred for auto-invest, or select project and invest (minimum Php 1,000 per project).

To know more about SeedIn, you may check this

video.

You can also join our FB group "Seedin PH Investors" by clicking

here.

This feature gives you accessibility to your account statistics.

- Available Funds - the investor's balance available for investment/pledge.

- On Hold Funds - are proceeds from loan application on hold for admin approval and funds that will be requested for withdrawal.

- Invested Funds - funds that are invested through the SeedIn Platform (amount of total invested funds since you joined SeedIn).

- Total Net Payout - the receivable balance of ongoing investments (principal plus interest)

The minimum investment amount will differ depending on the size of the project. You can invest as low as Php 1,000.00 for every project.

The amount you've credited will be placed on hold until the subscription period for the project you've invested in has ended. It cannot be used to invest in another project unless it is transferred back to your available funds.

Your funds will be invested for the term of your specific funding. The business funding terms usually range from one to twelve months. Seedin's average funding term is between three to six months.

Each of Seedin's Participation Contract states clearly that monthly interest distributions occur on a fixed day of each month. This fixed day is based on the date of maturity of the Participation Contract. If the investor subscribes to a product offering after the start of the funding date, the first month's interest distribution will be pro-rated.

For example, Seedin places a product offering online whereby the subscription period is for a maximum of 30 days from June 1 to 30. If your funds are cleared into our accounts and you invest in the product offering anytime between the subscription period, you will receive the interest distributions made on the succeeding months of each month until maturity.

Yes, you can participate in more than one project as long as you have sufficient credits in your SeedIn account.

No, when a project is fully subscribed, it will no longer be available for subscriptions.

If the project is still in the “midst of crowdfunding” you can email us at

info@seedinph.tech and provide the project investment ID number for the Admin team’s verification to cancel your investment.

SeedIn is committed to building wealth through passive income investing and providing better access to investment opportunity. Currently, we are only accepting accredited, institutional investors and private investors with relevant investment experience.

When you invest in a SeedIn product offering, you are investing through our Participation Contract. The contract states that the investor will receive a declared interest rate for a declared term that is reliant on the underlying funding between SeedIn and the SME issuer. Therefore, the Participation Contract is a contract between the investor and SeedIn.

While the investor does not have any ownership on the said funding or its security, the Participation Contract gives the investor an interest, shared with other investors who have funded the offering. Therefore, the investor obtains a right to receive monthly interest disbursements as well as the return of the principal sum when the SME issuer makes full payment on the funding.

Interest rates will differ from offering to offering but generally range from 7% to 10% per annum. As each funding is different, the interest rate is determined by a multitude of factors, inclusive of risk. SeedIn focuses mainly on funding for short-term working capital; therefore they are able to carry higher interest rates compared to other financing options.

An online contract will be generated and emailed to your registered email immediately upon subscription. Alternatively, you may log in to your user dashboard to view and download your contract.

The contract shall be governed and construed in accordance with the laws of Republic of the Philippines and the parties to the contract shall submit to the exclusive jurisdiction of the Courts of the Philippines.

The contract will be reassigned to SeedIn in the Event of Default, i.e. when the repayments have not been fulfilled or made in full by the sellers, and SeedIn, with the Power of Attorney to act on behalf of both principal parties, will take over as the legal principal of the assigned invoices.

The contract agreement is non-transferrable and is strictly between you and the issuer.

All members' monies are held in a segregated account with our Partner Bank(s) Trust Group. Other than the minimum balance funded by SeedIn to avoid unnecessary bank charges, at no time will the funds of SeedIn co-mingle with members' monies.

We do not use members' monies for any daily operations.

Audits will be performed by appointed 3rd party auditors at the end of each calendar year.

You can log on to your registered account to view your statement of account under your “Transaction History” tab.

No. As we are not a deposit-taking institution, the funds are held in a non-interest bearing bank account.

Yes, you may request to cancel your investment as long as the project is still in the “midst of crowdfunding”. You may email us at

info@seedinph.tech and provide the investment id # of the project for processing.

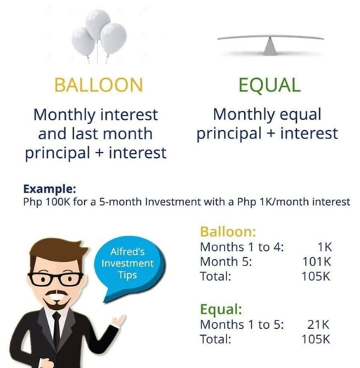

Types of Repayment

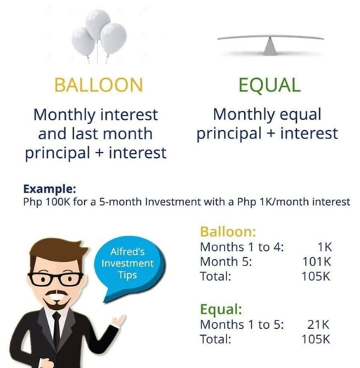

This type of repayment will put your principal funds on hold for the duration of the loan. For example: You have invested in a 5 months project, only the interest earned will be paid out on the 1st to 4th month and the principal will be released on the last month of the project.

A monthly repayment loan is one in which both principal and interest are spread over the term of the loan and paid on a monthly basis.

Bank Details and Top-Up Information

-

Bank Name

Only local banks are accepted. Please make sure that the name of the bank is correct.

-

Account Name

Accounts under a different name will be denied. This complies with the Anti-Money Laundering Act (AMLA).

-

Account Number

You will find this on your bank card, at the bottom of your name, or on your bank book.

-

Bank Address

The address of the bank you have registered with. If the bank has no specific address, indicate province and city of residence.

-

Swift Code

This is optional. You may search for the unique swift code of your bank via the internet.

-

Bank Proof

Before submitting your details, please ensure that you have provided a picture of your card or bank book. This must clearly show your name, bank, and account number for us to verify.

If you wish to ask for assistance in completing your account details, please do not hesitate to message us at

@seedinph or email us at

info@seedinph.tech, and one of our team will reach you as soon as possible.

Seedin offers different payment types with a minimum investment of P1,000. Below are the different ways to Top-Up on your account:

-

Bank Transfer transaction:

If you prefer to pay via bank transaction, kindly see the below details for our bank accounts. Please note that this option entails that you have to send proof of deposit or receipt to our customer service.

Bank Name: Security Bank

Account Type: Business Plus Checking Account

Bank Account Name: SeedIn Technology Inc.

Bank Account Number: 0000043737035

Branch: Malabon - Tugatog

Bank SWIFT Code: SETCPHMM

Bank Name: Union Bank of the Philippines

Account Type: Checking account

Bank Account Name: SeedIn Technology Inc.

Bank Account Number: 002570010360

Branch: Greenhills

Bank SWIFT Code: UBPHPHMM

Bank Name: Asia United Bank

Account Type: Checking account

Bank Account Name: SeedIn Technology Inc.

Bank Account Number: 020010041711

Branch: BGC-Taguig Branch

Bank SWIFT Code: AUBKPHMM

PROCESS: Profile > Top-up>Bank Transfer > Choose the bank where you deposited the funds > Upload a photo of the deposit slip.

-

Online Banking

For convenience, you may opt to pay using your bank’s online transfer feature by choosing the Online Banking alternative. For the Online Banking process, you may use this video for reference.

-

Mobile Wallet

For Gcash, Coins.ph, and other similar platforms, you may choose the Mobile Wallet option. For the Mobile Wallet process, click here for a step-by-step video tutorial.

-

Coins.ph Top -Up:

Coins.ph Direct

PROCESS: Profile > Top-up > Mobile Wallet > Coins.ph > Coins.ph Direct> Amount > Submit > You will be redirected to coins.ph website to confirm your payment please select “Pay with Coins.ph”>Sign In to your Coins.ph Account and confirm your payment.The funds should be credited to your seedin account real-time.

Coins.ph QR

PROCESS: Profile > Top-up > Mobile Wallet > Coins.ph > Coins.ph QR > Scan the QR that will flash on your screen to transfer the funds and secure the copy of successful transaction > Date of Transferred > Amount > You need to upload the transactions slip > Submit. This may take 12 to 24 hours processing time.

If the funds did not reflect on your account on the given time frame you may contact our customer service at our hotline number: T: (+632) 7586 4919/M: +639173277864 or email us at info@seedinph.tech.

Your primary bank account is where your funds will be credited back upon request of withdrawal. To change your primary bank, please contact us at

info@seedinph.tech.

The funds will reflect in your account depending on the type of payment used. For the Gcash, BPI Direct, and Coinsph top-up, funds should be credited in real-time. Bank Transfer and Online Banking transactions would take 12 to 24 hours processing time. Please always secure a copy of your successful transaction. You may contact customer support if the funds did not reflect on the given processing time.

The fees for the top-up and withdrawal will be at Seedin's expense. However, there are selected banks that will still charge fees once you top up your account.

Once you submit your application you can’t edit or make any changes to your bank details. You can also email us at

info@seedinph.tech if you wish to remove your existing bank account. Approval may take 3 working business days upon submission.

Please make sure that you secure a copy of your successful transaction and email us at

info@seedinph.tech so we can coordinate with our bank for validation.

If the transaction is pushed through and already deducted from your bank account we can’t cancel your top-up request anymore. You may request withdrawal of the fund on the platform once the funds reflect in your Seedin account and wait for the Admin team to process your request. You will be notified via email once we successfully transferred the funds to your bank account.

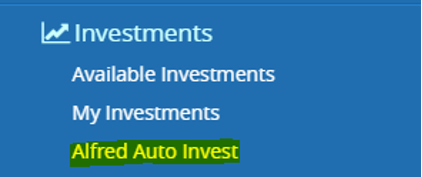

Alfred Auto-Invest

Alfred Auto Invest, named after Batman’s butler, Alfred Pennyworth, is a feature that allows investors to invest in our projects automatically depending on their investment preferences. If you decide that the investment is not for you, you may cancel it at any given time. This offers you the flexibility you like without the stress of squabbling over a piece of the pie. For more details please click

here.

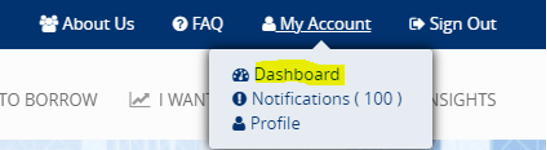

- Login to your SeedIn Account.

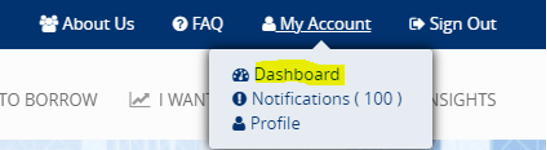

- Go to My Account and Select Dashboard.

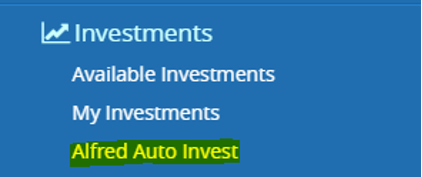

- Click Alfred Auto Invest on the left side of your screen and tick the box for the “I agree” button and submit. You can now create your own rule for auto investment.

To adjust Alfred, go to the “Alfred Auto Invest” page from your investor dashboard and click “Add Rule”. After that, you're ready to adjust and set your preferences. Below are the available preference settings:

- Interest Range

- Interest Tenure

- Allocation limit

To enable and activate the established rule, select "Yes". T. If a posted project meets the criteria set, Alfred Auto Invest will participate and invest in the transaction.

Please be informed that Alfred will only allocate 50% of the project and it will be divided fairly to all Alfred users.

For our Alfred process it is by queueing and round. Per round Alfred will get 1k on your funds until he completes the 50 % of the project.

Make sure you have selected your preferred rules and you should have sufficient funds once we post the project so Alfred can invest your funds.

Kindly make sure that you did not make any changes to your Alfred rules after we post the project.

By clicking the cancel button under "My Investments," you may cancel the investment Alfred automatically funded for you. Please take note that the cancellation option is only available during the crowdfunding stage.

Once you click the Alfred Auto Invest you will see on the upper right side a button where you can slide to turn it off/on.

Withdrawal of Funds

You can withdraw idling credits from your Seedin dashboard under the tab: Withdraw Funds. The money will be transferred to your bank account maintained in our records within 3-5 working days (Login required).

Bank to Bank: 2 to 3 banking days

Gcash: 12 to 24 hours. Please be informed that for 1st-time withdrawal it may take 2 to 3 business days since we need to enroll your gcash account to our gcash portal.

Coinsph: Real-time crediting to your coinsph account. Please be informed that the registered mobile number will be the basis of the system to transfer the funds to your coinsph account.

Should you need further assistance or details you may email or contact our customer service at

info@seedinph.tech.

SeedIn will be issuing a notice for your idling funds after 1 month. If your idling balance remains in your account after 90 days, SeedIn will proceed to credit the balance back to your registered bank account with SeedIn.

Other

A rise in interest rates will have a negative effect on the business market, as it will make funding more expensive for SME issuers. We are not able to predict or confirm if or when main interest rates will rise and how it might affect the sentiment for business expansion and working capital.

SeedIn is of the opinion that businesses must continue to thrive in both good and bad times. Funding is necessary for both business expansion and cash flow conservation; opportunities for business funding will therefore still be available. Nevertheless, SeedIn will constantly monitor the economy and interest rate movement as necessary to provide synergy between investors and issuers.

SeedIn is not able to predict trends in the economic cycle but opportunity exists in every business industry in different points of the economic cycle. During a market downturn, particular industries will continue to thrive and provide a suitable return in return for your investment.

It is our intention to ensure that funding opportunities that are well suited in particular points of the economic cycle is made accessible to our investors.

Yes, business funding investments are similar to investing in stock markets. It is difficult to know how and when the market conditions will change and affect the underlying funding in the product offering.

Retail/Qualified Investors are reminded to review the due diligence of each product offering, terms of use and Participation Contract to gain a full understanding of the product characteristics.

No. However, SeedIn has a set of legal mechanisms and contingency plans in place to mitigate such risks. In a worst case scenario, we are able to liquidate the asset and have reasonable expectation of being able to return most or our investors' entire principal.

SeedIn is one of the first debt crowd funding platforms in Asia to pioneer the use of "pre-funding" by investing its own money into the business financing. Every project we pre-fund proves our confidence in the business funding request, our risk assessment methods and due diligence methodology.

By way of pre-funding, we are able to secure higher interest rates and still retain issuers because of the speed and efficiency we provide in each offering we fund. Pre-funding also allows us to accelerate deal closing so that investors are able to earn their interest more quickly.

Traditional crowd funding requires all investors to wait until full funding is committed before a funding can be syndicated. Often, the time taken for full funding could be up to a month or even not occur at all.

Currently, SeedIn does not maintain a consistent position across each of its funding. We allow our investors to fill up 100% of the financing we pre-fund. However, we reserve the right to retain a position for each funding and may do so in the future. If an offering is not fully funded by investors, we will retain a position in the offering because we have already pre-funded it.

Although SeedIn makes a significant effort in keeping the risk of funding default to a minimum, all funding have an inherent amount of risk; investors may lose their entire investment.

SeedIn has a issuer default process in place to manage the situation as soon as possible by working with the SME issuer to understand the reason behind the default. Primarily, we would like to reach to an amicable solution with the issuer to protect the interests of the investors.

That withstanding, SeedIn has a set of legal mechanisms and contingency plans in place to mitigate such risks. We highly encourage our investors to understand each product offering clearly to understand the investment better.

During the course of our due diligence, apart from reviewing the SME ability to repay the funding, we also look into the capacity for the business to take on extra debt. This is necessary in the event of a possible default.

Generally, SeedIn would review the SME funding request and fund only as much as necessary for its working capital needs. Thus investors might see a funding request being separated into tranches to ensure the SME has the capability to repay.

Yes. Investments beyond traditional stocks, bonds, and cash are known as alternative asset classes. Alternative asset classes can include anything from commercial real estate and private equity to luxury watches and antiques.

Be advised that alternative asset classes are not appropriate for everyone. SeedIn investors must verify their investor status. SeedIn is not a registered financial advisor and does not make any financial recommendations. You should always consult a qualified financial or investment professional knowledgeable about your risk tolerance and objectives before investing in new opportunities.

Risk assessment is one of our highest priorities. High quality SMEs and good business operators are fundamental to the success of our platform. We employ a rigorous traditional underwriting process to craft detailed due diligence on prospective SME issuers.

The conditions of the local market, performance of the particular industry and risk profile of the SME issuer are reviewed so that we only curate professional and/or experienced businesses onto our platform for investor review.

We have an independent panel of experienced business professionals and investors on our Credit Risk Committee to advise on the risks involved across industries to give a better assessment of the funding.

Generally, we arrange secured lending and third party guarantee so that in a worst case scenario, we are able to liquidate the asset and have reasonable expectation of being able to recover most of our exposure.